On Monday 10th of November 2025, Apollo Sports Capital (ASC), the sports investment arm of alternative asset manager Apollo, bought majority control of La Liga giants Atlético Madrid.

The deal reportedly values the team at €2.5 billion ($2.9 billion), according to some sources. If true, it will be the second-highest price ever for a control sale of a football club, after the $3.16 billion purchase of Chelsea by Todd Boehly and Clearlake Capital in 2022.

FootballOrbit brings you all you need to know about Atlético’s new majority owners.

Apollo Sports Capital takes over Atlético Madrid

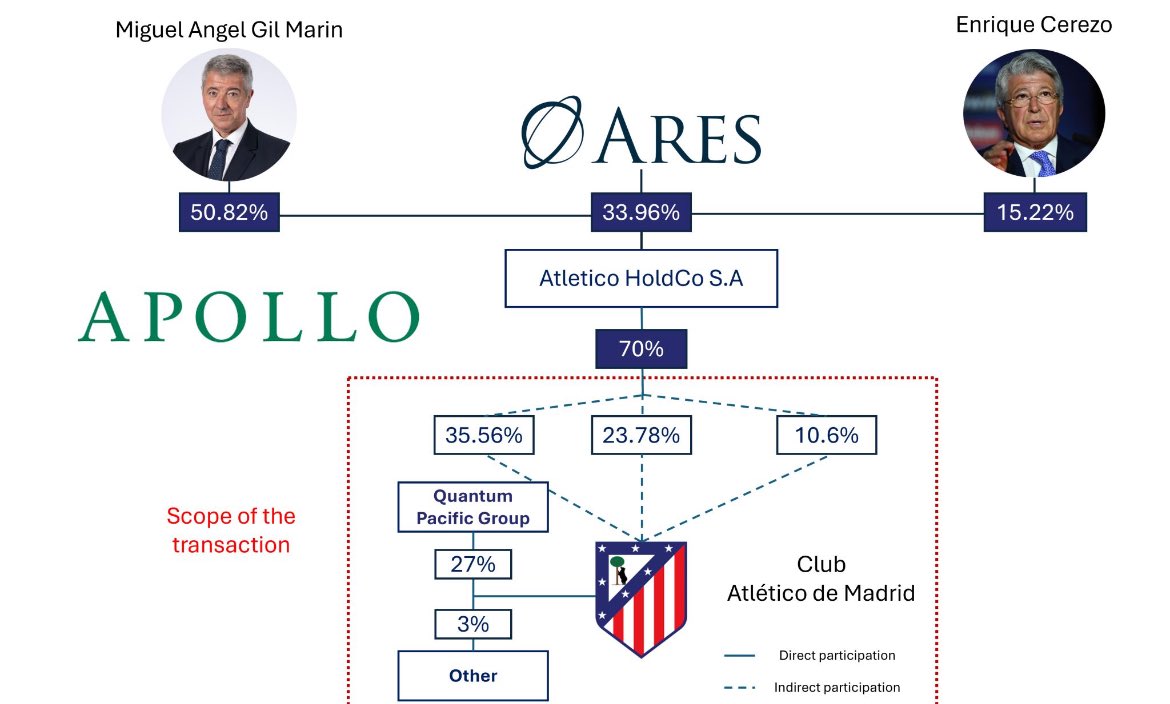

As part of the agreement, Miguel Ángel Gil and Enrique Cerezo will continue to lead the club as Chief Executive Officer and President, respectively. They will remain minority shareholders, ensuring continuity of vision and leadership.

The investment by ASC is expected to reinforce Atlético’s position among football’s elite and support its ambition to deliver long-term success for millions of fans worldwide.

Furthermore, as long-term investors, ASC and the existing shareholders will partner with the club’s management to enhance its financial strength, sporting competitiveness and community impact.

The shareholder group intends to invest additional capital to support the club’s long-term plans, including further investment in Atlético Madrid’s teams and in major infrastructure projects.

This includes the development of the Ciudad del Deporte, a new sports and entertainment district adjacent to the Riyadh Air Metropolitano stadium designed to serve as a world-class destination for sport, leisure, culture and community activity.

Moreover, drawing on Apollo’s deep expertise across the sports, media and entertainment ecosystem, ASC aims to create a vibrant, transformative, multi-use urban hub serving the wider Madrid community.

Atlético Madrid: Ownership History

In 1992, Spain’s new Sports Law forced all First and Second Division football clubs to convert into sports limited companies. Atlético Madrid, led by president Jesús Gil since 1987, was teetering on the edge of bankruptcy.

Meanwhile, the club scraped together enough capital to meet the requirements on the final day to compliance. Days later, Gil and then–vice president Enrique Cerezo quietly seized control of the club without paying a single peseta.

The maneuver was fraudulent, but it would take seven years for the so‑called Caso Atlético to reach court.

Furthermore, in 1999, Gil, Cerezo, and then‑director general Miguel Ángel Gil were charged with fraud and embezzlement. The courts confirmed the crimes — but the statute of limitations had already expired.

As a result, the shares remained in their hands, and the club’s ownership structure, born of a legal sleight of hand, was never undone.

Since 2003, Cerezo has served as the club’s president, while Miguel Ángel Gil Marín — son of former president Jesús Gil — has held the role of chief executive officer.

External investors

In 2015, the Chinese conglomerate Wanda Group purchased a 17% stake in Atlético Madrid.

In 2017, Quantum Pacific Group, owned by Israeli billionaire Idan Ofer, acquired a 15% stake in the club. The following year, Wanda Group sold its entire holding to Quantum Pacific Group, raising the latter’s ownership to 32%.

Moreover, after a 2021 capital increase, Gil Marín, Cerezo, and incoming investor Ares Management hold 66.98% of the shares through ‘Atlético HoldCo’.

Additionally, Atlético co-owns Liga MX club Atlético San Luis, and the Canadian Premier League side Atlético Ottawa.

On the 10th of November 2025, Atlético announced that United States-based Apollo Sports Capital (ASC) would acquire between 51 and 55% of its shares.

Ultimately, the deal makes ASC the new majority owners in a deal expected to be completed in the first quarter of 2026, subject to customary closing conditions, including regulatory approvals.

Who are those behind Apollo Sports Capital?

Apollo Sports Capital is a global sports investment company and affiliate of Apollo.

Apollo

Founded in 1990, Apollo Global Management, Inc is a high-growth, global alternative asset manager. The company invests money on behalf of pension funds, financial endowments, and sovereign wealth funds, as well as other institutional and individual investors.

Furthermore, the firm specializes in high-profile acquisitions, corporate restructuring, and strategic investments across sectors like energy, technology, media, infrastructure, and real estate.

Headquartered at the Solow Building, Manhattan, New York, (with offices in London, Frankfurt, Singapore, and Hong Kong); Apollo Global Management is publicly traded on the New York Stock Exchange under the ticker “APO,” currently valued around $130 per share

Also, one of its co-founders, Josh Harris, is now a shareholder in Premier League side Crystal Palace, as well as the NFL’s Washington Commanders, the NBA’s Philadelphia 76ers, and the NHL’s New Jersey Devils.

As of June 30, 2025, Apollo had approximately $840 billion worth of assets under management. It is the 26th-largest asset management firm in the world.

Among the most notable companies currently owned by Apollo are Yahoo!, Rackspace, Claire’s, Caesars Entertainment Corporation, Novitex Enterprise Solutions, Apollo Education Group, The Restaurant Group, Gamenet, Lumileds, West Corp, Constellis, Jacuzzi, Noranda Aluminium, and CORE Media Group.

Apollo Sports Capital (ASC)

On the 29th of September 2025, Apollo announced the launch of Apollo Sports Capital (ASC), a new investment business providing capital solutions across the global sports and live events ecosystem.

ASC was funded with about $5 billion to invest in credit and hybrid opportunities in the sports landscape, spanning franchises, leagues, venues, media, events and more.

The permanent capital holding company is designed to be a stable, long-term partner to the sector, providing patient capital and adding strategic value.

ASC is expected to build on Apollo’s established presence in sports, with Apollo’s managed funds having deployed approximately $17 billion to-date in the broader space. This includes investments in sports and entertainment companies, media rights, and stadium and league financings.

Announcing the establishment of Appolo Sports Capital (ASC), Co-President of Apollo Asset Management John Zito said:

“With Apollo Sports Capital, we’ve set out to build the preeminent investment company in the growing world of sports. Our aim is to create durable, long-term value not only for investors but also for fans, teams and communities.”

Atlético de Madrid will be ASC’s flagship majority equity investment and is NOT part of a multi-club control ownership strategy.

Other recent investments by Apollo Sports Capital include the Mutua Madrid Open and Miami Open tennis tournaments, in partnership with Ari Emmanuel and Mark Shapiro’s new company MARI.

ASC is led by CEO Al Tylis, co-Portfolio Managers Rob Givone and Lee Solomon, and Chief Strategy Officer Sam Porter.

Prior to joining ASC, Tylis led numerous sports investments, including as owner and chairman of Club Necaxa, La Equidad and the Brooklyn Pickleball Team.

Additionally, he serves on the boards of G2 Esports, United Pickleball Association and Canvas Property Group, and is the co-founder of the Tylis Family Foundation.

Tylis is also a former real estate executive, having most recently served as president and CEO of NorthStar Asset Management.

The new ownership structure of Atlético Madrid

Following the takeover, the ownership percentages of Atlético Madrid’s primary stakeholders are as follows:

| Owner | Stake (%) |

| Apollo Sports Capital | 55 |

| Quantum Pacific Group | 25 |

| Miguel Ángel Gil Marín | 10 |

| Ares Management Group | 5 |

| Enrique Cerezo | 3 |

| Others | 1.5–2 |

What are Apollo’s plans for Atlético?

Apollo’s arrival at Atlético brings with it a sense of ambiguity. Though Miguel Ángel’s ownership (and his father’s before him) has been unpopular with many fans, the board’s behavior — especially with respect to sports planning — has been largely predictable.

Likewise, Atlético’s economic upsurge in recent years shows management has played its cards right in expanding the club’s reach and consolidating its position as one of Europe’s biggest sporting institutions.

Given the nature of its business, Apollo’s focus is on one thing: consistent growth in its investment.

Thus, a significant financial injection is anticipated upon ASC’s ascendance to majority ownership.

Apollo reportedly valued Atlético at €2.5 billion, so by buying 55% of the shares it will contribute around €1.3 billion to the club.

According to Libertad Digital’s David Vinuesa Malbec, the promise of this investment is what convinced Mateu Alemany to join Atlético as the club’s new sporting director last month, a move which has pushed director of football Carlos Bucero out of the picture.

However, Apollo has no plans to sell starman, Julian Alvarez, and ASC is expected to supply Alemany with the funds necessary to add more quality players around the Argentine forward — whom they understand is crucial if Atlético are to win the UEFA Champions League for the first time in its history.

Furthermore, there is the question of whether manager, Diego Simeone, will sign another contract. The 55-year-old has spent almost 14 years at the helm and is the highest paid football manager in the world.

However, Fernando Torres (currently managing the club’s youth side, Atlético Madrileño) and Filipe Luís (coaching Brazilian side, Flamengo) have been positioning themselves in the background as potential successors to Simeone when his contract expires after next season.

Conclusion

Atlético Madrid are one of the most successful Spanish clubs, having won 11 La Liga titles, including a league and cup double in 1996. Further domestic trophies include 10 Copa del Rey titles, two Supercopas de España, one Copa Presidente FEF and one Copa Eva Duarte.

They have also won numerous titles in Europe, including the European Cup Winners’ Cup in 1962, the UEFA Europa League in 2010, 2012 and 2018, and the UEFA Super Cup in 2010, 2012 and 2018, in addition to the 1974 Intercontinental Cup.

In the UEFA Champions League, Atlético reached the final in 1974, 2014 and 2016.

One thought on “Meet Apollo Sports Capital: The New Majority Shareholders Of Atlético Madrid”